How CFOs Are Redefining Leadership in an AI-Driven, Volatile World

In a global economy shaped by geopolitical fragmentation, macroeconomic strain, and the rapid rise of artificial intelligence, the role of the chief financial officer (CFO) has never played a more pivotal part in guiding strategy amid disruption.

Economist Impact’s new report, “Beyond the balance sheet: The new CFO mandate,” sponsored by SAP, reveals how CFOs are shifting from stewards of financial accuracy to architects of business resilience, digital innovation, and long-term value. Based on input of 480 CFOs globally, the report highlights widening responsibilities, rising risk pressures, and an urgent need to adopt AI with both speed and discipline.

To lead effectively through volatility, today’s CFO agenda demands operational agility, intelligent automation, and a reimagined approach to workforce development. Here’s how today’s finance leaders are adapting.

The expanding CFO mandate

Gone are the days when CFOs focused solely on financial planning and reporting. Today, their influence extends far beyond traditional finance boundaries. Nearly 90% of CFOs report they are more involved in digital transformation and risk management than three years ago. Two-thirds are actively shaping sustainability and ESG strategies.

This evolution reflects a broader truth. CFOs are now central to decisions that impact customers, products, and talent. They are expected to anticipate disruption, mitigate risk, and enable agility—all while safeguarding profitability.

Macroeconomic, geopolitical, and technological shifts are pushing CFOs deeper into operational decision-making. As one CFO quoted in the report explained, finance leaders today must “wear multiple hats” and develop a deep understanding of business fundamentals, processes, and controls to guide transformation effectively.

With expectations rising and responsibilities converging, the next challenge is clear: aligning these expanded priorities with the capabilities required to execute them.

A sharper risk radar in an uncertain world

CFOs are on the front lines of uncertainty with increasing pressure to keep risks and costs from ballooning. In fact, more than 80% of CFOs reported that they are now more involved in risk management and compliance, with 34% significantly so.

Yet, it is not higher costs that worry CFOs most, it is unpredictability. Inflation, shifting trade rules, and increased interest rates make capital allocation more challenging, with only 37% feeling confident about meeting liquidity targets, compared with nearly 90% for revenue goals.

In response, CFOs are doubling down on what they can control. AI-enabled scenario planning is enabling faster, more sophisticated modeling, while real-time operational signals are being translated into forward-looking risk indicators. Flexibility has also become essential, from upgrading systems for adaptable production to renegotiating vendor contracts with shorter, more variable terms.

Ultimately, the mandate is clear: build organizations that can absorb shocks, respond in real time, and maintain strategic momentum despite uncertainty.

CFOs at the center of AI adoption

Digital transformation has become a core responsibility of the CFO’s role, with nearly nine in ten reporting increased involvement—much of it centered on AI. Finance leaders cite especially strong potential in compliance, where generative AI can parse complex regulations, track rule changes, and automate updates to internal systems.

But several challenges stand in the way of scaling AI’s impact:

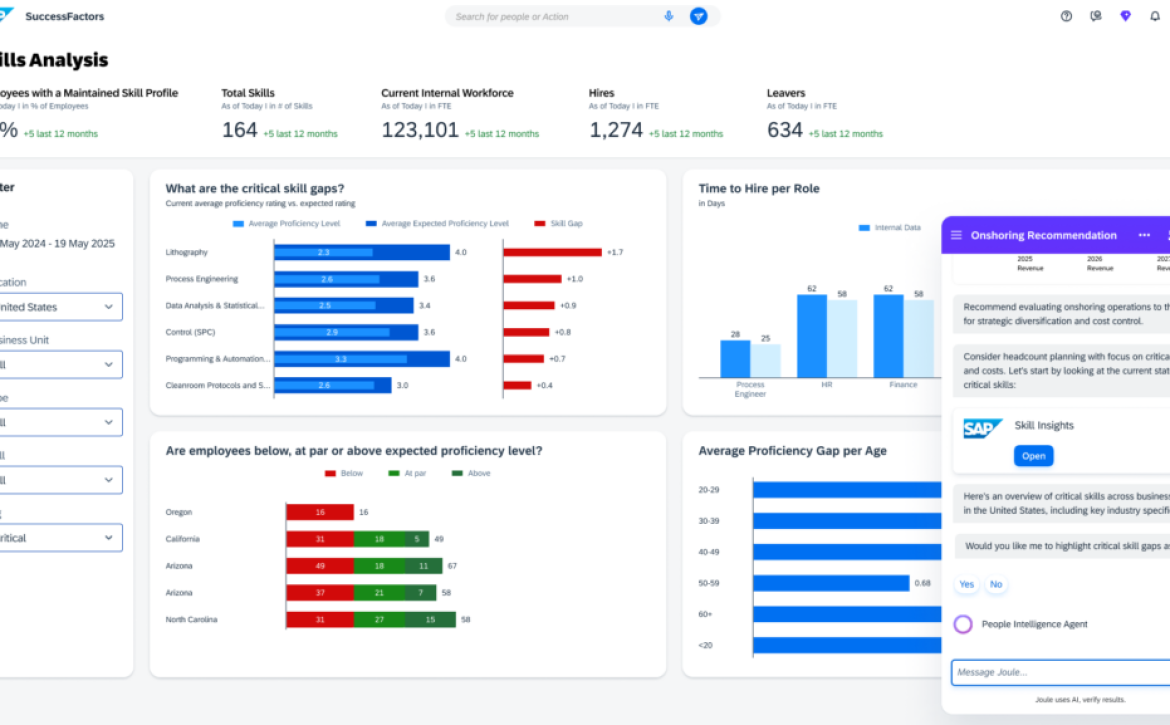

Talent: the biggest barrier to AI acceleration

More than 60% of CFOs cited upskilling and hiring digitally fluent talent as top challenges, with fragmented systems and limited real-time data access adding further friction. As a result, CFOs are strengthening both team skills and data quality, recognizing that AI can only scale when people know how to use it and the data behind it is trusted.

The ROI paradox

CFOs must deliver quick wins from AI even though its most meaningful gains in forecasting, innovation, and growth take longer to materialize. To resolve this tension, leading CFOs are setting clear performance benchmarks, directing AI toward revenue-driving use cases, and coordinating across the business to scale capabilities that unlock sustained value.

Designing the workforce for an AI future

While AI is reshaping work, rising concerns about workforce displacement remain a real challenge for finance teams. However, nearly seven in ten CFOs see AI as a tool to augment human capability, prompting a rethink of roles, skills, and hiring decisions. Leading CFOs are redesigning early-career roles, investing in digital and analytical skills, and building blended teams that pair human judgment with AI-driven insight to strengthen the leadership pipeline.

Taken together, these shifts signal a broader evolution: finance is moving from a function rooted in historical reporting to one defined by predictive insight, real-time decision support, and enterprise-wide capability building.

CFOs who balance rapid efficiency with long-term investment in data, skills, and new ways of working will turn AI into a sustainable competitive advantage rather than a short-lived productivity boost.

Looking ahead: the new CFO playbook

Economist Impact’s research shows that the modern CFO shapes how organizations navigate risk, adopt AI, and build the workforce capabilities required for continuous transformation.

This shift demands a new playbook that unlocks capacity through automation, strengthens cross-functional alignment, builds flexibility into systems and supply chains, and reimagines finance career paths for a digital-first future. As one interviewee noted, “The modern CFO is not just the guardian of value but the architect of future value.” That future will belong to leaders who pair disciplined cost and risk management with bold investment in data, skills, and AI-driven insight.

With SAP’s financial management solutions, finance leaders can unify data, processes, and intelligence to meet the expanding demands of the role. As the expectations placed on finance continue to grow, SAP remains committed to empowering CFOs with the clarity and confidence needed to lead through uncertainty and shape a more resilient future.

Learn more about SAP financial management solutions.

David Imbert is head of Product Marketing for Finance at SAP.